The impact of ERP on financial reporting and data accuracy – ERP’s impact on financial reporting and data accuracy is a topic that deserves careful consideration. The implementation of ERP systems has revolutionized the way businesses manage their financial data, leading to significant improvements in accuracy, efficiency, and transparency. Before ERP, financial reporting was often a manual and time-consuming process prone to errors. However, with the advent of ERP, businesses can now streamline their data collection, automate their financial processes, and gain real-time insights into their financial performance.

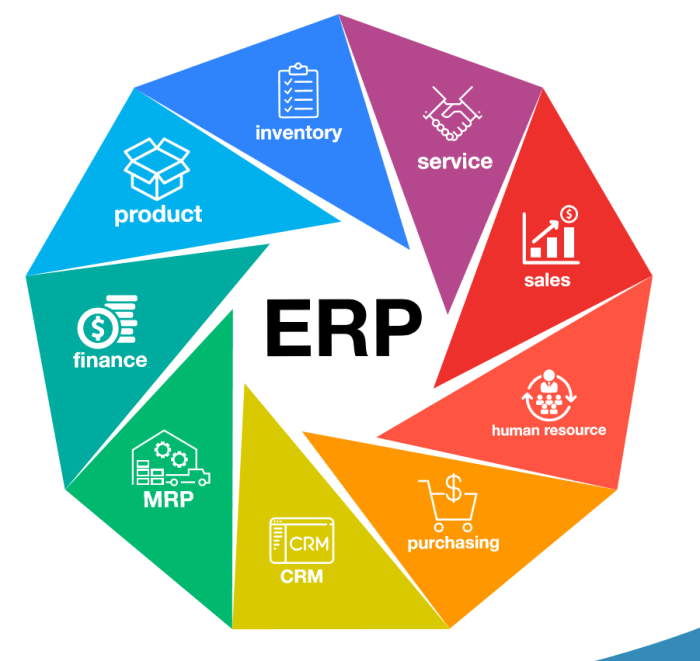

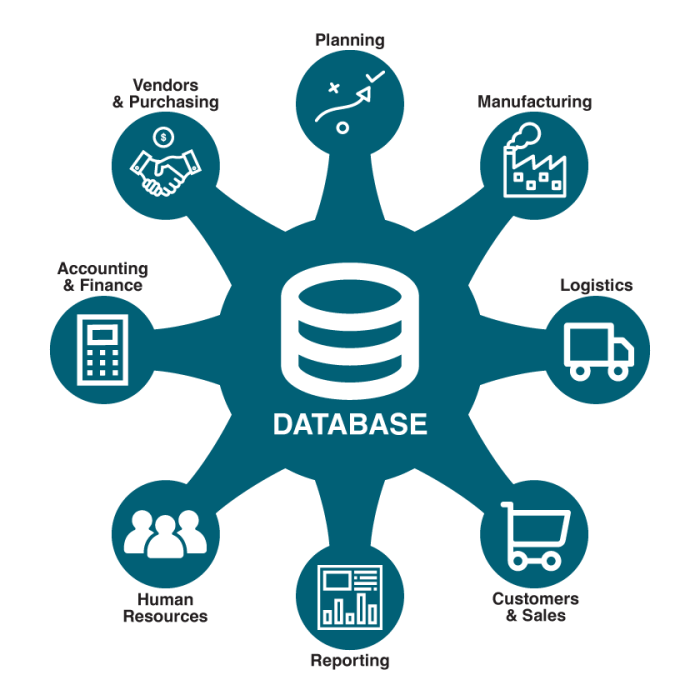

ERP systems are designed to integrate all aspects of a business, including finance, accounting, human resources, and supply chain management. This integration allows for a centralized repository of data, eliminating the need for manual data entry and reducing the risk of errors. Moreover, ERP systems provide robust data validation and integrity checks, ensuring that the information being reported is accurate and reliable.

This improved data accuracy translates into more reliable financial statements, better decision-making, and enhanced investor confidence.

Introduction

An Enterprise Resource Planning (ERP) system is a comprehensive software solution designed to manage and integrate various business processes, including finance, human resources, supply chain, and customer relationship management. ERP systems are crucial for businesses of all sizes as they streamline operations, improve efficiency, and provide real-time insights into critical data.Financial reporting is a cornerstone of any business, providing essential information for stakeholders like investors, creditors, and management.

It involves summarizing and presenting financial data to understand a company’s performance, financial health, and future prospects. Accurate and timely financial reporting is vital for informed decision-making, regulatory compliance, and maintaining investor confidence.

Historical Challenges in Financial Reporting

Before the advent of ERP systems, businesses relied on manual processes and disparate systems for managing their financial data. This resulted in several challenges that hampered financial reporting accuracy and efficiency:

- Data Silos: Data was often fragmented across different departments and systems, making it difficult to consolidate and generate accurate financial reports. For example, sales data might be stored in a separate system from inventory data, leading to discrepancies and inconsistencies.

- Manual Processes: Financial tasks such as data entry, reconciliation, and reporting were often performed manually, increasing the risk of errors and delaying the reporting process. This was particularly time-consuming and prone to mistakes when dealing with large volumes of transactions.

- Lack of Real-time Visibility: Businesses struggled to obtain real-time insights into their financial performance due to the reliance on manual processes and disparate systems. This hindered timely decision-making and proactive management.

- Limited Auditability: The lack of standardized processes and data integrity made it challenging to track and audit financial transactions, increasing the risk of fraud and compliance issues.

These challenges significantly impacted the accuracy and reliability of financial reporting, leading to delays, inconsistencies, and potential misstatements.

Impact of ERP on Financial Reporting

ERP systems have revolutionized financial reporting by providing a centralized platform for managing data, automating processes, and enhancing real-time visibility. This section explores how ERP systems improve financial reporting accuracy and efficiency.

Streamlining Data Collection and Consolidation

ERP systems streamline data collection and consolidation by integrating various departments and functions within an organization. This integration eliminates the need for manual data entry and reconciliation, reducing errors and saving time. For instance, sales data from the sales department is automatically fed into the ERP system, eliminating the need for manual data entry and reconciliation. This integration ensures consistency and accuracy across different departments, resulting in a unified view of financial data.

Automating Financial Processes

ERP systems automate various financial processes, such as accounts payable, accounts receivable, and budgeting. This automation reduces manual effort, minimizes human error, and accelerates the financial reporting cycle. For example, ERP systems can automate invoice processing, payment reminders, and budget allocation, freeing up finance teams to focus on more strategic tasks. The automation of these processes also ensures that financial transactions are recorded accurately and consistently, leading to improved data integrity.

Real-Time Visibility into Financial Data

ERP systems provide real-time visibility into financial data, enabling organizations to make informed decisions quickly. For example, finance teams can monitor cash flow, track inventory levels, and analyze sales performance in real-time. This real-time access to financial data empowers businesses to identify trends, respond to market changes, and make timely adjustments to their financial strategies.

Improved Accuracy and Consistency of Financial Reporting

ERP systems enhance the accuracy and consistency of financial reporting by standardizing data collection, processing, and reporting procedures. This standardization eliminates inconsistencies and errors that often occur in manual processes. For example, ERP systems enforce predefined accounting rules and policies, ensuring that all financial transactions are recorded consistently across the organization. This standardization leads to more reliable financial statements, which are essential for accurate financial decision-making.

Data Accuracy and ERP

ERP systems play a crucial role in enhancing data accuracy, which is essential for reliable financial reporting and informed decision-making. By integrating various business processes and data sources, ERP systems provide a single source of truth, reducing the risk of inconsistencies and errors.

Data Accuracy Features of ERP

The data accuracy capabilities of ERP systems stem from various features that ensure data integrity and consistency throughout the system. Here are some key features:

- Centralized Database: ERP systems maintain a centralized database, eliminating the need for multiple data silos and reducing the risk of data duplication or inconsistencies. This unified data repository serves as a single source of truth for all business operations.

- Data Validation and Integrity Checks: ERP systems incorporate data validation rules and integrity checks to prevent inaccurate or incomplete data from being entered. These rules ensure that data conforms to predefined standards, such as data types, formats, and business rules. For instance, an ERP system might prevent a user from entering a negative value for a quantity or a date that is in the future.

- Automated Data Entry and Processing: ERP systems automate data entry and processing, reducing manual errors and improving efficiency. Automated data entry eliminates the need for manual data transcription, minimizing the risk of human error. For example, when a sales order is created, the system automatically updates inventory levels, customer accounts, and sales reports.

- Real-Time Data Updates: ERP systems provide real-time data updates, ensuring that information is always current and accurate. This real-time visibility enables timely decision-making based on the most up-to-date data. For instance, a manager can track inventory levels in real time and make informed decisions about ordering new stock.

Impact of Data Validation and Integrity Checks

Data validation and integrity checks are critical components of ERP systems, ensuring that data entered is accurate, complete, and consistent. These checks can be implemented at various stages, including data entry, data processing, and data reporting.

- Data Entry Validation: Data validation rules at the data entry level prevent incorrect data from being entered into the system. For example, an ERP system might require a user to enter a valid customer ID before proceeding with a sales transaction. This ensures that only authorized customers are included in the system.

- Data Processing Integrity Checks: Integrity checks during data processing ensure that data transformations and calculations are performed correctly. For example, an ERP system might verify that the total value of a sales order matches the sum of the individual line items. This helps to prevent errors in financial calculations.

- Data Reporting Accuracy: Data validation and integrity checks contribute to the accuracy of reports generated from the ERP system. By ensuring data consistency and completeness, reports provide a reliable basis for decision-making. For instance, a financial report generated from an ERP system with robust data validation and integrity checks will be more accurate than a report generated from a system without these features.

Data Accuracy Levels Before and After ERP Implementation

ERP implementation typically results in significant improvements in data accuracy. Before ERP implementation, organizations often rely on manual processes and disparate systems, leading to inconsistencies and errors in data.

- Before ERP:

- Manual Data Entry: Manual data entry is prone to errors, especially when dealing with large volumes of data. Human error can lead to inaccurate data entry, which can cascade throughout the system.

- Multiple Data Silos: Organizations often have multiple data silos, with different departments using separate systems and databases. This fragmentation can lead to inconsistencies and difficulty in reconciling data across different systems.

- Lack of Data Validation: Without robust data validation mechanisms, inaccurate or incomplete data can easily slip through the cracks. This can lead to errors in financial reporting and decision-making.

- After ERP:

- Centralized Database: ERP systems provide a centralized database, eliminating the need for multiple data silos and reducing the risk of data duplication or inconsistencies.

- Automated Data Entry: ERP systems automate data entry, minimizing human error and improving data accuracy.

- Data Validation and Integrity Checks: ERP systems incorporate data validation rules and integrity checks to ensure data accuracy and consistency.

ERP and Data Governance and Compliance, The impact of ERP on financial reporting and data accuracy

ERP systems facilitate data governance and compliance by providing a framework for managing data access, security, and integrity.

- Data Access Control: ERP systems allow organizations to control data access based on user roles and permissions. This helps to ensure that only authorized individuals can access sensitive data.

- Data Security Measures: ERP systems incorporate security measures to protect data from unauthorized access, modification, or disclosure. These measures include encryption, access controls, and data backups.

- Auditing and Reporting: ERP systems provide auditing and reporting capabilities to track data changes and identify potential issues. This information can be used to ensure data integrity and compliance with regulations.

- Compliance with Regulations: ERP systems can help organizations comply with industry regulations, such as Sarbanes-Oxley (SOX) and General Data Protection Regulation (GDPR). By providing a framework for data management and security, ERP systems help organizations meet these regulatory requirements.

Benefits of ERP for Financial Reporting

Enterprise Resource Planning (ERP) systems have revolutionized financial reporting by providing a comprehensive and integrated platform for managing all aspects of a business. The benefits of ERP extend beyond mere automation, offering significant improvements in data accuracy, efficiency, and decision-making capabilities. This section delves into the key benefits of ERP for financial reporting, showcasing how these systems empower organizations to achieve greater transparency, reliability, and agility in their financial operations.

Improved Efficiency and Timeliness of Financial Reporting

ERP systems streamline financial reporting processes, leading to increased efficiency and faster turnaround times. By automating tasks such as data collection, consolidation, and reporting, ERP reduces manual effort and eliminates potential errors associated with human intervention.

| Benefit | Description | Example |

|---|---|---|

| Automated Data Collection and Consolidation | ERP systems integrate data from various departments and sources, eliminating the need for manual data entry and reconciliation. This automated process ensures data consistency and accuracy across the organization. | A company can use ERP to automatically collect sales data from its point-of-sale systems, inventory data from its warehouse management system, and expense data from its expense management system. This data is then consolidated into a single database, providing a complete and accurate picture of the company’s financial performance. |

| Real-time Reporting and Analytics | ERP systems provide real-time access to financial data, allowing for immediate insights into key performance indicators (KPIs) and trends. This real-time visibility empowers decision-makers to react quickly to changing market conditions. | A company can use ERP to track its sales revenue in real time, allowing it to identify any trends or anomalies that may require immediate attention. This information can be used to adjust marketing strategies, optimize inventory levels, or take other actions to improve financial performance. |

| Faster Reporting Cycle | By automating data collection and consolidation, ERP systems significantly reduce the time required to generate financial reports. This allows for quicker dissemination of financial information to stakeholders. | A company that previously took several days to generate its monthly financial statements can now produce them in a matter of hours using ERP. This allows the company to provide its investors with timely and accurate financial information. |

Challenges and Considerations

Implementing and integrating an ERP system can bring significant benefits to a business, but it’s not without its challenges. Careful planning, execution, and ongoing management are essential for successful ERP implementation.

Data Quality Issues

Data quality is critical for accurate financial reporting. Poor data quality can lead to inaccurate financial statements, misinformed decision-making, and compliance issues. Common data quality issues associated with ERP systems include:

- Data Duplication: This occurs when the same data is entered multiple times, creating inconsistencies. For example, a customer’s name and address might be entered differently in different modules of the ERP system.

- Missing Data: Incomplete data records can lead to inaccurate financial reports. For example, missing invoice details can result in an incorrect sales figure.

- Inaccurate Data: Errors in data entry can lead to inaccurate financial reports. For example, a typo in an invoice amount can result in an incorrect revenue figure.

- Data Inconsistency: When data is not consistent across different systems or modules, it can lead to confusion and inaccuracies. For example, if the customer’s address is different in the sales module than in the inventory module, it can create problems with order fulfillment and inventory management.

Data Management Practices

Effective data management practices are essential for ensuring data accuracy and consistency in an ERP system. These practices include:

- Data Governance: Establishing clear data ownership and responsibility helps ensure data accuracy and consistency. It also involves defining data standards and processes for data collection, validation, and maintenance.

- Data Cleansing: This process involves identifying and correcting data errors, inconsistencies, and duplicates. Regular data cleansing is essential for maintaining data quality.

- Data Backup and Recovery: Having a robust data backup and recovery plan is essential for protecting data from loss or corruption. Regular backups ensure that data can be restored in the event of a disaster.

- Data Security: Implementing strong data security measures is crucial for protecting sensitive financial data from unauthorized access. This includes access control measures, encryption, and regular security audits.

ERP Implementation Steps

Implementing an ERP system for financial reporting involves a series of steps, as illustrated in the flowchart below:

[Flowchart depicting the steps involved in ERP implementation for financial reporting]

Future Trends

The integration of emerging technologies into ERP systems is rapidly transforming the landscape of financial reporting. This evolution is driven by the need for real-time insights, enhanced data accuracy, and improved decision-making capabilities. Let’s explore how AI, machine learning, and blockchain are poised to revolutionize ERP for financial reporting.

The Role of AI and Machine Learning

AI and machine learning are playing a pivotal role in automating tasks, improving data analysis, and enhancing financial reporting accuracy. These technologies can:

- Automate data entry and reconciliation: AI-powered systems can analyze data from various sources, identify discrepancies, and automatically reconcile accounts, reducing manual effort and minimizing errors.

- Improve forecasting and budgeting: Machine learning algorithms can analyze historical data, identify trends, and predict future financial performance, enabling more accurate budgeting and forecasting.

- Detect anomalies and fraud: AI can identify patterns and deviations from normal financial behavior, flagging potential fraud or anomalies that might otherwise go unnoticed.

Real-Time Reporting and Analytics

The demand for real-time insights is driving the evolution of ERP systems towards real-time reporting and analytics capabilities. This enables businesses to:

- Gain immediate visibility into financial performance: Real-time reporting provides a constant stream of updated financial data, allowing businesses to track performance metrics and identify potential issues in real time.

- Make data-driven decisions faster: Access to real-time data empowers businesses to make informed decisions quickly, responding to market changes and opportunities with agility.

- Improve operational efficiency: Real-time insights into financial performance can be used to optimize processes, identify bottlenecks, and improve overall operational efficiency.

The Impact of Blockchain Technology

Blockchain technology holds immense potential for transforming financial reporting within ERP systems. Its decentralized and immutable nature offers several advantages:

- Enhanced data security and integrity: Blockchain’s distributed ledger technology ensures that data is tamper-proof and secure, reducing the risk of fraud and manipulation.

- Streamlined audit trails: Blockchain records all transactions in a chronological and immutable ledger, providing a transparent and auditable trail for financial transactions.

- Improved transparency and accountability: Blockchain’s transparent nature fosters greater trust and accountability in financial reporting, as all stakeholders can access the same immutable data.

The implementation of ERP systems has undeniably transformed the landscape of financial reporting. By streamlining data collection, automating processes, and enhancing data accuracy, ERP has empowered businesses to make more informed decisions, improve their financial performance, and gain a competitive edge. As technology continues to evolve, we can expect even greater advancements in ERP systems, further enhancing their capabilities and driving greater value for businesses.

Frequently Asked Questions: The Impact Of ERP On Financial Reporting And Data Accuracy

What are the key challenges in implementing ERP for financial reporting?

Implementing ERP can be a complex and challenging process, requiring careful planning, coordination, and resources. Common challenges include data migration, system integration, user training, and change management. It’s crucial to address these challenges proactively to ensure a successful implementation.

How can I ensure the accuracy of data within my ERP system?

Data accuracy is paramount for effective financial reporting. Implementing robust data validation rules, conducting regular data audits, and training users on proper data entry practices are essential. Consider using data quality tools to monitor and improve data accuracy over time.

What are the future trends in ERP for financial reporting?

The future of ERP for financial reporting is exciting, with advancements in artificial intelligence (AI), machine learning (ML), and blockchain technology. These technologies will further automate processes, enhance data analytics, and improve the efficiency and accuracy of financial reporting.